FxPro Account Types

Open a trading account that will suit your trading style. Review the current list of available account types.

For traders in South Africa who are starting with forex trading or looking to improve their strategies, choosing the right FxPro account type is a crucial decision. Each account offers specific features, benefits, and conditions tailored to different trading approaches, experience levels, and financial goals.

Overview of FxPro Account Types

The types of trading accounts that are currently available are listed below. It should be noted that there may be some differences in commissions and other terms of service depending on the region of residence. Up-to-date and comprehensive information is available after registering in the personal area. You can also always contact our first-class support team for advice.

Standard Account: An Entry Point for Beginners

The Standard Account serves as an ideal starting point for those new to forex trading or traders preferring a simplified approach with inclusive spreads. With a minimum deposit of just $100, this account type provides accessibility to a wide range of investors.

Raw+ Account: Tight Spreads for Active Traders

Designed for traders who prioritize the tightest possible spreads, the Raw+ Account provides raw spreads starting from 0 pips on FX and gold pairs. This account carries a commission fee of $3.5 per side, making it suitable for those who value low spreads over commission costs.

Elite Account: Premium Offering for Investors

The Elite Account is FxPro's premium offering, tailored for traders with substantial trading capital. Requiring a minimum deposit of $30,000 within the first two months, this account caters to high-net-worth individuals or professional traders.

| Account Type | Standard Account | Raw+ Account | Elite Account |

| Initial Deposit | $100 | $1000 | $30k in 2 months |

| Leverage | Up to 1:200 (1:10k for Pros) | Up to 1:200 (1:10k for Pros) | Up to 1:200 (1:10k for Pros) |

| Charges/Cost | FX (all-inclusive spread) | FX (Raw + $3.5/side) | FX (Raw + $3.5/side) |

| Spreads from EURUSD, GBPUSD, USDJPY | 1.2 pips | 0 pips | 0 pips |

| Average spread EURUSD, GBPUSD, USDJPY | 1.5 pips | 0.2 pips | 0.2 pips |

| Charges/Cost for Gold | (all-inclusive spread) | (Raw + $3.5/side) | (Raw + $3.5/side) |

| Spreads for Gold | from 25 cents | from 10 cents | from 10 cents |

| Average Spread for Gold | 30 cents | 15 cents | 15 cents |

| Charges/Cost for Bitcoin | (all-inclusive spread) | (all-inclusive spread) | (all-inclusive spread) |

| Spreads for Bitcoin | from 30 USD | from 15 USD | from 15 USD |

| Average Spread for Bitcoin | 40 USD | 20 USD | 20 USD |

| Trade Size | From 0.01 | From 0.01 | From 0.01 |

| Margin Call / Stop Out | 60%/50% | 60%/50% | 60%/50% |

| Platform | MT4/MT5 | MT4/MT5 | MT4/MT5 |

| Swap Free | Yes | Yes | Yes |

| Rebates | N/A | N/A | Start from $1.5 per lot |

It is also worth mentioning the special account types that can be set up under the above options.

VIP Account: Exclusive Benefits for High-Volume Traders

Traders in South Africa with exceptionally high deposits, typically $50,000 or more, can access the VIP Account, which comes with an array of exclusive benefits. These include a 30% discount on market spreads, complimentary VPS service, and the potential for reduced commissions on the cTrader platform (up to a 30% discount).

The VIP Account aims to deliver a truly premium trading experience, with personalized support and customized trading conditions tailored to the specific needs of high-volume traders.

Islamic Account: Swap-Free Trading for Religious Compliance

FxPro recognizes the diverse religious beliefs of its clients and offers Islamic (swap-free) accounts for those who cannot pay or receive interest due to their religious principles. Available at the Standard trading account level, these accounts provide an extended swap-free status by default, allowing traders to engage in forex trading without incurring swap charges or rollover fees.

Demo Account: Risk-Free Practice Environment

For those new to forex trading or wishing to test novel strategies without risking real capital, FxPro provides a free demo account. This risk-free environment allows traders to practice trading with virtual funds and gain valuable experience before transitioning to a live account. With a validity of 180 days, the demo account offers ample time to refine skills and build confidence in trading.

How to Open the Right Type of Trading Account

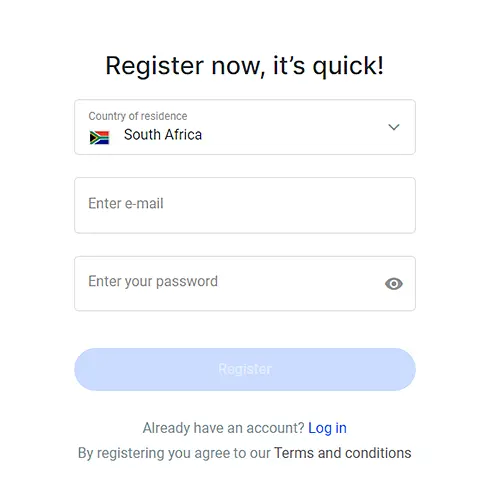

Start by Registering with a Broker

Visit the FxPro website and click on the “Register” button located at the top of the page. Provide your personal details, such as your name, email address, and country of residence, and create a secure password for your account.

- Verification: Upon registration, you will gain access to your personal FxPro Direct account area. Here, you will be prompted to complete the verification process by submitting the required documentation, such as a valid government-issued ID and proof of address.

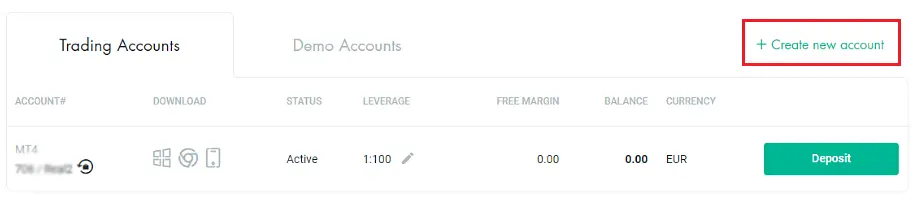

- Account Selection: After successful verification, navigate to the “Accounts” section within your FxPro Direct account area. Here, you can select the type of trading account you wish to open, whether it’s a Standard, Raw+, Elite, or any other account type offered by FxPro.

- Account Setup: Provide the necessary information to set up your chosen account type, including your preferred base currency, leverage level, and any additional preferences or settings.

After your deposit has been processed, your live trading account will be activated, and you can start trading on your chosen platform (MT4, MT5, cTrader, or any other supported platform).

Platform Compatibility and Trading Approaches

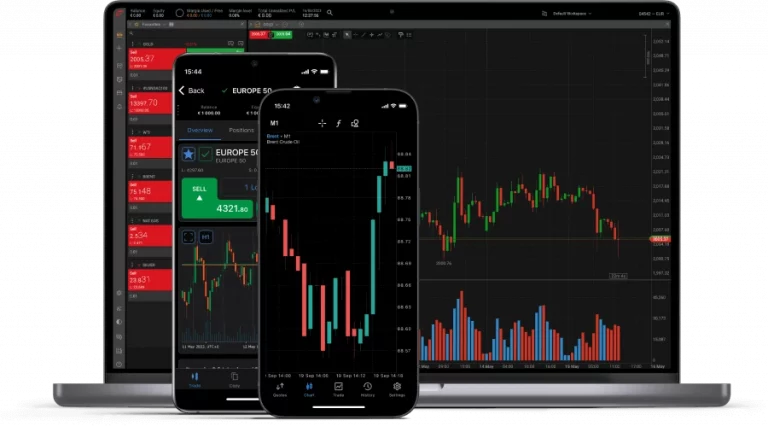

FxPro offers its accounts on multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, catering to diverse trading preferences among traders.

MT4, a classic and widely adopted platform, is renowned for its user-friendly interface, automated trading capabilities, and an extensive library of third-party indicators and expert advisors (EAs).

MT5, a more advanced and feature-rich platform, supports a broader range of financial instruments, including stocks and futures, alongside forex and CFDs.

cTrader, developed by Spotware Systems, is a popular platform that offers advanced trading features, swift execution, and a wide array of financial instruments. Known for its transparency and fair trading conditions, FxPro cTrader utilizes direct processing technology (STP) to execute trades directly with liquidity providers.

How to Choose the Optimal Type of FxPro Account?

Selecting the most suitable account type depends on various factors, including your trading experience, capital, trading approach, and preferences. Here are some general guidelines to consider:

If you are new to forex trading, the Standard Account may be the most appropriate option.

The Standard Account offers an accessible entry point with a low minimum deposit and all-inclusive spreads, making it easier to manage costs while you learn and gain experience.

Traders with more extensive experience and larger trading capital may benefit from the Raw+ or Elite Accounts.

These account types offer raw spreads from 0 pips on FX and gold pairs, potentially reducing overall trading costs for high-volume traders who are willing to pay commissions. Furthermore, the Elite Account provides rebates, which can further offset commission expenses.

If you are a high-net-worth individual or a professional trader with substantial capital and trading volumes, the VIP Account may be the most suitable choice.

This premium account offers exclusive benefits, such as discounted spreads, free VPS service, and reduced commissions on the cTrader platform, providing a personalized trading experience tailored to your specific needs.

Traders who employ scalping or day trading strategies may find the Raw+ or Elite Accounts more advantageous due to the tight spreads and potentially lower overall trading costs.

However, it’s crucial to consider the impact of commissions on frequent trading, as they can quickly accumulate for high-frequency traders.

If your trading approach involves holding positions for longer periods, such as swing or position trading, the Standard Account with its all-inclusive spreads may be a more cost-effective option, as commission fees can add up over extended holding periods.

The main takeaway is that the choice of account should align with your level of experience, the amount of capital, and your trading style. It’s important to consider not only the minimum deposit requirements but also to evaluate the trading commissions.

FAQ About Account Types

Can I have multiple accounts with FxPro?

Indeed, you can establish up to five distinct trading accounts with this broker, providing you with the flexibility to diversify your trading strategies and manage risk across different account types.

Does this FX broker offer micro accounts?

Yes, FxPro supports trading micro lots (0.01 lots) across all account types, making it suitable for traders with smaller capital investments.

Do you offer swap-free accounts?

FxPro offers swap-free (Islamic) accounts, but fees may apply if certain trades remain open beyond a set number of days. To request a swap-free account, email [email protected]. For full details on these accounts, contact Customer Support.

Is copy trading available in the proposed accounts?

Yes, the social trading platform is accessible for all accounts. You can find detailed information about this feature and the corresponding trading platform on the FxPro Copy Trading page.

Can I open an account in a currency other than USD?

Yes, this broker offers multiple base currencies for trading accounts, including EUR, GBP, CHF, JPY, ZAR, among others. You can select your preferred base currency during the account registration process.

Does this broker offer spread betting accounts?

Yes, spread betting accounts are available to clients of FxPro UK Limited residing in the United Kingdom. These accounts are accessible through the proprietary FxPro Edge platform, allowing tax-free trading on a variety of asset classes.

Can I open a corporate trading account?

Yes, corporate trading accounts can be opened in your company’s name. You’ll need to provide official company documents, such as a certificate of incorporation and articles of association, during the account setup process.

Do I need to pay any money to open an account?

The broker does not charge any fees simply for opening an account. Commissions are paid based on the volume of trades executed. You can find more detailed information on the fee structure when selecting your account type.

Try Trading Without Risk

Start trading with a trusted international broker today. Sign up and get access to a free demo account with a $100000 virtual balance and full access to all tools to get a good feel for the platform.